Yacht VAT Exemptions

Italian & French Commercial Exemptions / 70% Rule

As a commercial yacht willing to operate with the tax exemption scheme in France and Italy, you are aware of the required criteria and what it implies in terms of tracking and supervision work.

Let us remind you the 5 criteria to respect, allowing you to create and sign the Commercial Activity Certificates:

- The yacht is commercially registered

- The yacht has permanent crew

- The yacht is engaged in commercial activity

- The yacht is at least 15 meters long

- The yacht left territorial waters (respectively French or Italian) for at least 70% of the trips carried out during the previous year

VAT on yacht charter fees

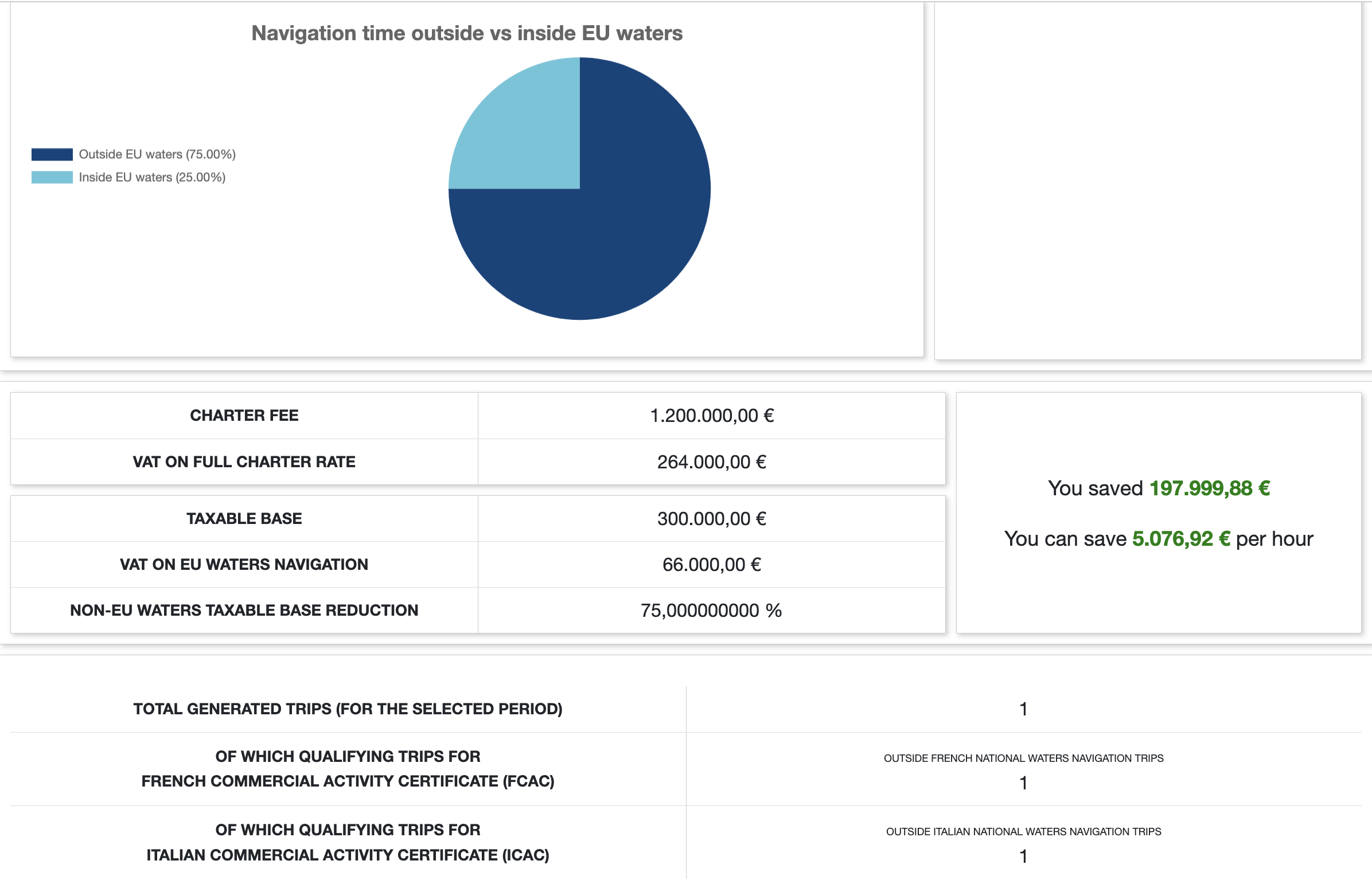

The time of navigation spent outside of EU waters should not be subject to the payment of any VAT by a charterer. From now on, you will be able to offer the possibility to your charter guests to pay ONLY the righteous amount due, in terms of VAT on the charter fee, when starting in France and Italy. LogNav calculates, in real-time, the prorata due VAT on charters (on time spent in EU waters only)

What the LogNav system does for the user:

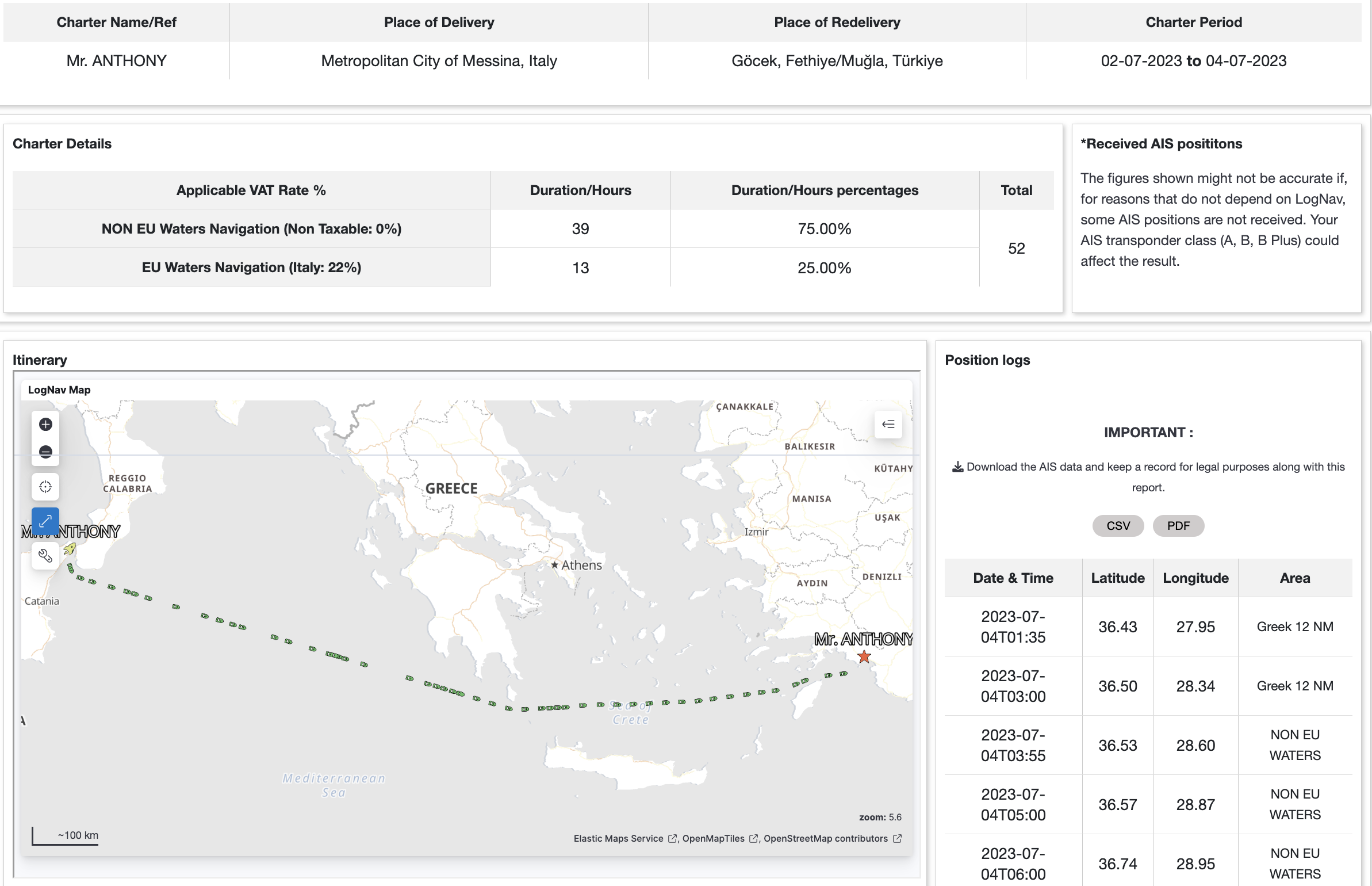

- Tracks & records hourly AIS positions and logs

- Acknowledge automatically & records the crossings of internal, national & non EU waters

- Processes the charter fee filled by the user through the algorithm (geographical, applicable rate of VAT per region and mathematical inputs)

- Displays a real-time dashboard including: Itinerary, Position logs, pie chart of IN/OUT EU waters navigation, VAT on full charter rate VS VAT on EU waters navigation only.

- Generates (downloadable) reports which include all necessary and probative data for the tax authorities.